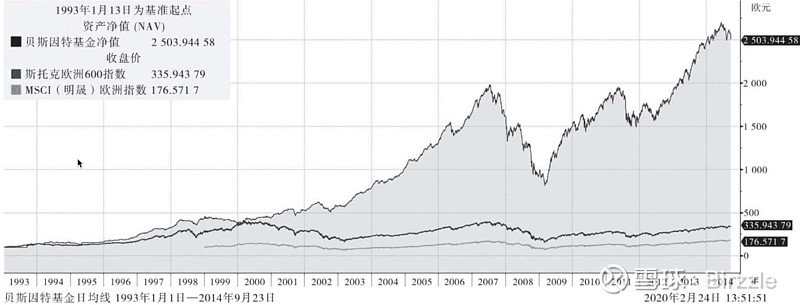

看了号称西班牙彼得林奇的《长期投资》,其投资从1991年2014,25年30倍,年化15%。

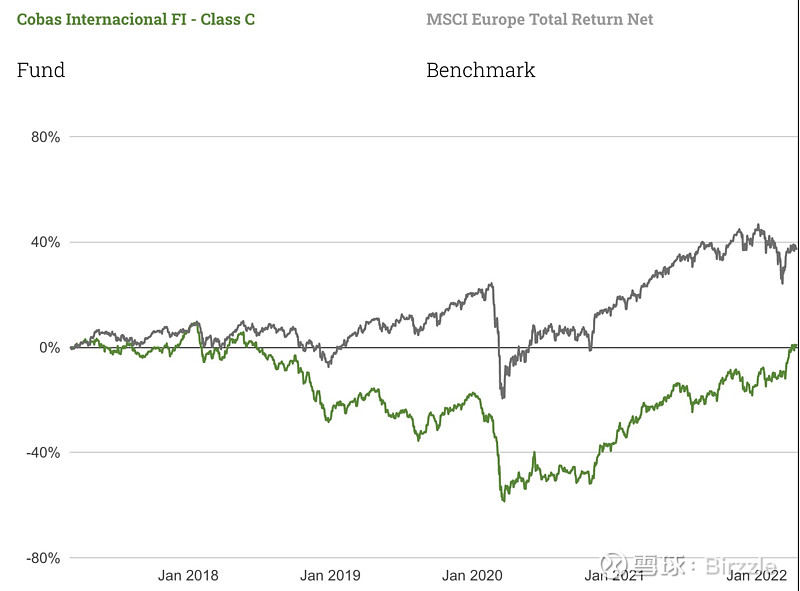

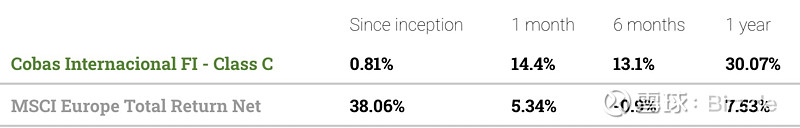

但是,Francisco 2017成立自己的基金公司(Cobas Asset Management)后,到今天2022年收益率基本是0,大幅跑输对比指数。

这个前后两阶段的投资结果差异之大,让我不禁对价值投资甚至主动投资产生了怀疑。也许Cobas的4支基金并不是由本人主理?也许作者真的太在意估值,买的都是偏烟蒂的公司?毕竟他2005年才开始相信”质量“,并且表示难以改变。也许虽然长期阅读,但遭遇了自己的信息茧房,没能跟上时代?毕竟在他眼里2014年了”谷歌还是个年轻小伙子“。也许当下真的是市场错了,和2000年互联网泡沫没有区别?

翻看近几年的comments ,我也没有找到答案。

2019 Q4

In a market where equity investment funds based in Spain have seen redemptions of more than 4 billion euros, and after two tough years behind us, our management company has ended 2019 in a very different position, with nearly 15 million euros of net inflows.

前两年基金留出了40亿,2019年总算是正收益,净流入了1500万。

基金坚持长期投资,认为当下市场的热点(Fad),是成长股,而不是价值股:

The fashion we discussed in earlier letters is the market's recent fondness for Growth stocks instead of Value stocks

作为价值投资者,偏向于买“便宜货” (bargain basement):

As value investors, we prefer to buy in the "bargain basement": stocks growing at reasonable rates and trading at low multiples or even very cheaply.

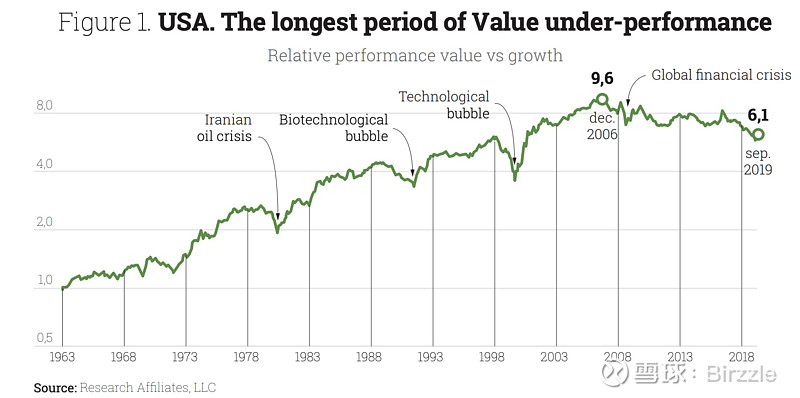

价值股长期来看会跑赢成长股:

We point out that over the long run investment in value stocks garners a better return than growth stocks. From 1963 to 2006, value stocks outperformed growth stocks by a factor of 6 (see figure 1). To be sure, for some periods value stocks underperform, such as during the tech bubble in 2000. But after those specific periods, value stocks rally to make up the lost ground.

从2006年开始,价值股相对成长股开始低估:

The graph also shows that the current period, from December 2006 to the present day, is the longest period during which value stocks have underperformed with respect to growth stocks.

一个可能的原因是S&P 500 指数中的头部公司都开始是互联网或科技公司。

In the past three years, the stock market appreciation of the 5 largest companies of the S&P 500 (all of them Tech or Internet companies) accounted for a large part of the rise in that index, even though those companies' profit growth did not keep up the pace (see figure 2)

然后将这种情况同2000年互联网泡沫做了对比:

We saw a similar situation between 1998 and 2000 and witnessed how the market corrected these mismatches.

由此可知,我们对价值投资中的价值,分歧是有多大。

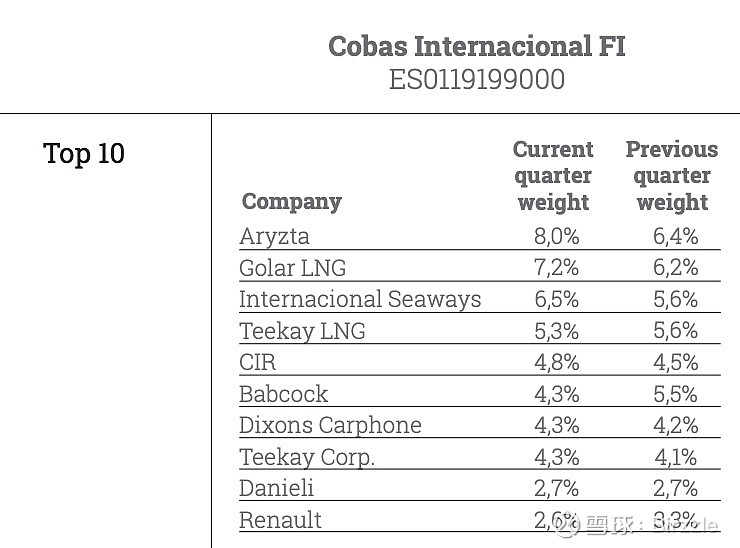

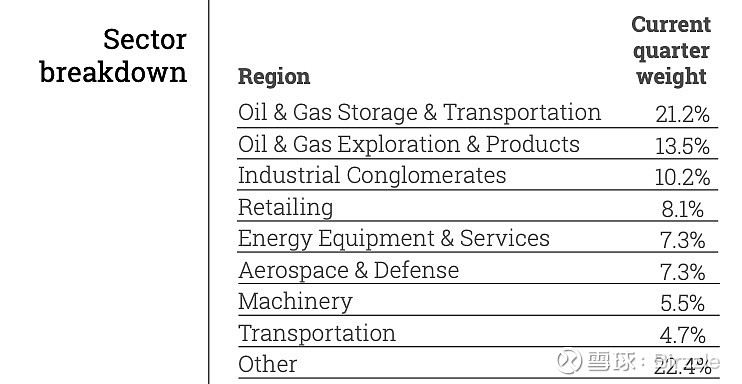

国际基金当前持仓:

其中,Aryzta (食品),Golar LNG (天然气海运),International Seaway (海运?),teekay LNG (天然气海运)。

到了2021 Q4,持仓还是集中在以上领域:

2021 Q4

2021 终于跑赢了指数,但是公司认为自家基金还是低估:

we are not satisfied and believe that there is still some way to go to reach the target value of our funds, which is still 100% above NAV.

一如既往,日常就是深入研究企业,等待市场发现。

This level of knowledge we have on the companies makes us confident that patience will pay off and we expect this to happen sooner rather than later, as the investment thesis of our companies continues to move in the right direction.

这份报告中讨论了些宏观通胀的问题,这里不细看了。公司也表示并不预测宏观,只是需要大致知道我们当前在哪里:

At Cobas AM we do not invest based on our view of the macroeconomy. No one has a crystal ball, and it is impossible to know with certainty what will happen in the economy and markets in the future

作为观察,公司会给出自己基金的目标价:

也就是说,虽然到2021年整4年基金是大幅偏离目标价的,具有上涨131%的潜力。