前文:制药业破产的商业模式-第一部分:行业已濒临致命的衰退 网页链接

Pharma’s broken business model — Part 2: Scraping the barrel in drug discovery

制药业破产的商业模式-第二部分:药物发现领域的竭泽而渔

by kelvin stott — on May 2, 2018 01:13 PM EDT

(作者Kelvin Stott,系诺华制药公司的研发组合投资管理经理)

In Part 1 of this blog, I introduced a simple robust method to calculate Pharma’s Internal Rate of Return (IRR) in R&D, based only on the industry’s actual historic P&L performance. Further, I showed that Pharma’s IRR has followed a rapid and steady linear decline over 20 years, which is consistent with recent estimates from BCG and Deloitte, and can be fully explained by the Law of Diminishing Returns as a natural and unavoidable consequence of prioritizing a limited set of investment opportunities while each new drug raises the bar for the next. Finally, I showed that a simple extrapolation of this robust linear trend means that Pharma’s IRR will hit 0% by 2020, which implies that the industry is now on the brink of terminal decline as it enters a vicious cycle of negative growth with diminishing sales and investment into R&D.

在这篇博客的第一部分,我介绍了一种简单可靠的方法去计算制药企业研发方面的内部收益率(IRR),仅仅以业内真实的历史损益表现为基础。随后,我展示了这20年来,制药企业的内部收益率一直在快速而稳定地线性下滑,这与最近BCG和德勤最近的测算一致,此现象可以被边际效益递减规律所解释,而这又是对有限的投资机会排优先级而造成的自然而然、却又不可避免的结果,而且,每一个新药都为其后继者设定了一个更高的门槛。最后,我展示了对这一稳定的线性趋势做简单外推的结果:到2020年,制药企业的内部收益率将降到0%,这意味着,现在行业已经濒临致命的衰退,因为它将进入销售负增长、研发投资负增长的死循环。

Here in Part 2, I explore the mathematical relationship between R&D productivity, IRR and past and future P&L performance in more detail. In particular, I show how the linear decline in IRR actually corresponds to an exponential decline in nominal Return on Investment (ROI) as a more direct measure of R&D productivity, which then leads directly to terminal decline in future P&L performance. I then use this model to run some what-if scenarios, to explore how much we will need to improve nominal R&D productivity/ROI in order to maintain positive P&L growth. The results show that we need a major breakthrough right now, in 2018, and even then we will face a period of significant contraction before any recovery, while anything less would be too little, too late to save the industry from terminal decline.

在第二部分,我探索出研发效率、内部收益率(IRR)、历史和未来损益表现之间的细节的数学关系。特别是,我将展示,内部收益率的线性下降实际上是与名义投资回报率(ROI)相对应的,这是衡量研发效率的更直接的方式,而这将直接导致未来损益表现的致命衰退。随后,我将利用这个模型去做一些情景假设,以探索我们还需要对名义研发效率/名义投资回报率做多大改进,才可以保持正数的利润增长。结果显示,我们现在,即2018年,就需要一次重大突破,而且即便如此,我们仍将在复苏之前面临严重的衰退;而如果改善不够,那么,对于把行业从致命的衰退中拯救出来的任务来说,其结果仍然会太小、太迟。

Finally, I identify the single limiting factor that is ultimately responsible for driving the decline in R&D productivity by the Law of Diminishing Returns, and I explain why many of Pharma’s past and current strategies (continuous improvement, new discovery technologies, in-licensing, precision medicine, big data and AI, etc.) have all failed and will continue failing to address the underlying issue. Moreover, I propose an alternative strategy that might just solve the problem, but while I have my own specific ideas in this area (not shared here, sorry), I hope to stimulate more critical strategic thinking, self-reflection and open debate in order to refocus the industry’s attention on developing alternative solutions to tackle the underlying issue before it is too late.

最后,我会确认边际效益递减规律是导致研发效率下降的唯一根本原因,并且我会解释为什么制药企业以往和当前的各种策略(持续渐进的提升、新药发现的新技术、授权引进、精准医疗、大数据和人工智能,等等)都失败了,而且在解决根本问题上还将继续失败下去。最后,我将提出一种替代策略,也许能解决此问题,但我在这个领域还有一些特殊的想法(不在这里分享,抱歉),我希望能够激发更多批判性的战略思考、自我反思和公开辩论,以便将行业的注意力重新集中在开发替代方案上,从而解决根本问题,以免为时已晚。

Nominal ROI as a direct measure of R&D productivity

名义投资回报率作为研发效率的直接测量指标

In Part 1, I showed that Pharma’s Internal Rate of Return in any given year x can be calculated by the following formula, based only on the industry’s actual historic P&L performance:

在第一部分,我展示了制药企业在任意给定的年份x的内部收益率可以用如下公示计算,只需以行业真实的历史损益数据为基础:

IRR(x) = [(EBIT(x+c) + R&D(x+c)) / R&D(x)]^(1/c) - 1

Where c is the industry average investment period of 13 years, from an initial R&D investment to the resulting commercial returns.

在这里c是行业内的平均投资期,即13年,从最初的研发投资开始到产生商业回报为止。

Moreover, I showed that Pharma’s historic IRR has followed a rapid and steady decline over 20 years, which fits the following linear equation almost perfectly (R^2 = 0.9916):

不仅如此,我还展示了制药企业的历史内部收益率持续快速且稳定地下降了超过20年,这几乎完美地符合下面的线性方程式(R^2 = 0.9916):

IRR(x) = -0.00912*(x-2020)

This means that Pharma’s IRR has been declining at a steady rate of about 0.9% per year and is projected to hit 0% by 2020. This robust downward trend has recently been confirmed by yet another data point from Deloitte, which reported that Pharma’s IRR fell to a new record low of just 3.2% in 2017.

这意味着,制药企业的内部收益率一直稳定地以每年0.9%的速度下滑,并且预计到2020年时,它将触及0%。这一稳定的下降趋势被德勤最近发布的报告中的新数据所再次证实,该报告称制药企业的内部收益率跌至历史新低:2017年仅仅只有3.2%。

The IRR defines an effective interest rate that provides a more complete and accurate measure of return on investment over time, but R&D productivity is best defined and more easily understood as a simple efficiency ratio. In particular, the nominal Return on Investment (ROI) in any year x measures the absolute nominal value of commercial returns vs original R&D investment over the average investment period c:

内部收益率定义了一个有效的回报率,它是在考虑时间的情况下,更加完整且精确的投资回报的测量方式,但研发效率是最好的定义方式,而且更容易理解,可被理解为简单的效率比。特别是,任意一年x的名义投资回报率(ROI)可以由平均投资期c年后的绝对名义商业回报的值除以最初投资的值来得到:

ROI(x) = (EBIT(x+c) + R&D(x+c)) / R&D(x)

As explained in Part 1, note that the ultimate commercial returns include not only EBIT, but alsofuture R&D spending as an optional use of profits that result from the original R&D investment.

如第一部分的解释,需要注意,最终的商业回报不仅包括息税前利润(EBIT),还包括未来的研发开支,因为这是以前研发投资获得的利润的可选用途。

Now, by substituting this equation into the original formula for IRR above, we can see that IRR is directly related to the nominal ROI as follows:

现在,通过将该方程代入上述内部收益率的原始公式,我们可以看到,内部收益率与名义投资回报率直接相关,如下所示:

IRR(x) = ROI(x)^(1/c) - 1

And conversely:

然后反过来:

ROI(x) = [1 + IRR(x)]^c

Finally, by substituting the historic linear trend above into the IRR term of this equation, and the industry average investment period of 13 years into the cterm, we get the following formula, which shows that nominal R&D productivity/ROI currently stands at about 1.2 (i.e., we get only 20% back on top of our original R&D investment after 13 years), is declining exponentially by about 10% per year, and will hit 1.0 (zero net return on investment) by 2020:

最后,将上面的历史下降趋势代入到公式中的IRR项,把c项设定为13年的行业平均投资期,我们将得到如下公式,它显示,名义研发效率/投资回报率目前在约1.2位置(即最初投资研发的13年之后,我们仅仅能赚到20%的回报),并且以每年10%的指数级下降,并且将在2020年触及1.0(投资的净回报为零):

ROI(x) = [1 - 0.00912*(x-2020)]^13 ≈ 0.899^(x-2020)

This result is consistent with an earlier report by Scannell et al., which shows that Pharma R&D productivity (in terms of NMEs per $Bn R&D spend) has been declining exponentially by about 7.4% per year since 1950 (99% over 60 years). Note that the 2.6% difference in the annual rate of decline must be explained by a decline in the average commercial value per NME, most likely due to diminishing incremental benefit as each new drug raises the bar and reduces the scope for improvement by the next, as well as increasing competition from generics and me-too drugs.

这个结果以之前Scannell等人的报告一致,它显示出,制药行业的研发效率(以每10亿美元研发开支创造出的新分子实体(NME)的数量的形式)一直在以指数级下滑,从1950年起每年约下滑7.4%(60年累计下滑99%)。注意,年下降率2.6%的差异可以由每个新分子实体的平均商业价值的下降所解释,其原因很可能是每个新药都为其后继者设定了更高的门槛,也缩小了后继者可以提升的空间,因而后继者的增量价值也减少了,同时,来自仿制药和me-too药物的竞争也更加激烈。

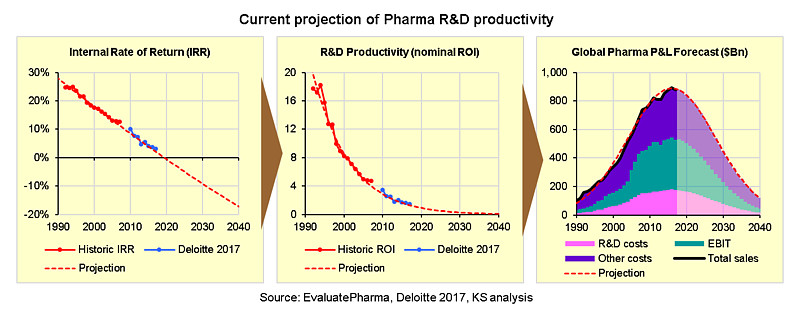

The direct mathematical relationship between IRR, nominal R&D productivity/ROI, and both past and future P&L performance is illustrated in the following 3 charts. Note that the trends represented by red dotted lines in each chart are all fully consistent with each other according to the formulae above, and fit closely with the historic P&L data as well as recent IRR estimates from Deloitte.

内部收益率、名义研发效率/投资回报率之间的直接数学关联,以及过去和未来的损益表现可以由下面3张图来展示。注意,每张图上由红色的点表示的趋势与根据上述公式所计算出的趋势完全一致,而且也非常符合历史损益数据及德勤最近测算的内部收益率。

Now we can see clearly, in real terms, just how fast R&D productivity has been declining.

现在我们可以清晰地看到,真实情况中,研发效率究竟下滑得有多么快。

Furthermore, we can now use these formulae to predict the impact of improving nominal R&D productivity/ROI on future P&L performance, either by continuous improvement or by making major technology breakthroughs, in order to determine just how much improvement is required to maintain positive P&L growth and avoid terminal decline.

不仅如此,现在我们可以使用这些公式去预测研发效率或名义投资回报率的提升对未来损益表现的影响,包括持续渐进式的提升或重大的技术突破,以计算出究竟需要多少提升才能保持正数的利润增长,以避免致命的衰退。

Impact of continuous improvement in R&D productivity

研发效率的持续渐进式的提升的影响

The ultimate goal of continuous improvement is to improve overall R&D productivity over an extended period of time, either by increasing the number or commercial value of new approved drugs, or by decreasing the R&D investment required to develop each new drug, or possibly a combination of both. In any case, change is slow and efficiency is improved only gradually by small amounts each year over many years.

持续渐进式的改进的最终目标是在较长时期内提高整体研发效率,这要么来自提升新批准药物的数量及其商业价值,要么来自降低每个新药所需的研发开支,或者更可能是这两者的结合。在任何状况下,改变都是缓慢的,效率的提升来自年复一年的小幅渐进提升的积累。

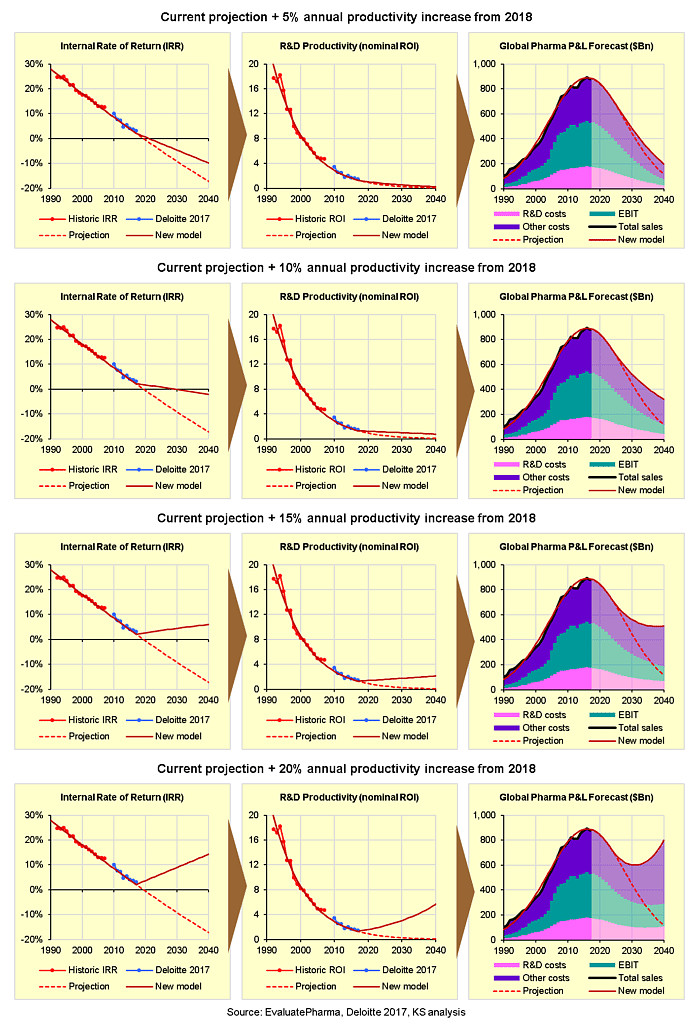

So by how much do we need to increase nominal R&D productivity/ROI each year in order to maintain positive P&L growth and avoid terminal decline? Is it 5%, 10%, 15% or even 20%? And by when do we need to start making these annual improvements? Has anyone even asked these questions before?

那么,我们必须每年提升多少名义研发效率/投资回报率,才能保持正数的利润增长,以避免致命衰退?5%、10%、15%,甚至20%?我们必须从什么时候启动这个逐年提升的过程?有人之前问过这些问题吗?

Before we use the formulae above to calculate the impact of continuous improvement on future P&L performance, consider that any improvements must be applied to the current baseline. In other words, we must counteract the current annual decline in R&D productivity before we can start increasing overall R&D productivity in absolute terms. On that basis, the expected impact of consistently improving nominal R&D productivity/ROI by 5%, 10%, 15% or 20% each year from 2018 is shown in the following charts:

在我们使用上述这些公式去计算持续渐进式的提升对未来损益表现的影响之前,请考虑到,所有的改进都必须适用于当前基线。也就是说,我们必须先抵消掉当前年度研发效率的下降,随后我们才可以提升整体的研发效率。在此基础上,从2018年起,每年持续提高5%、10%、15%或20%的名义研发效率/投资回报率的预期影响如下图所示:

What we can see is that improving R&D productivity by 5% or even 10% each year from 2018 would slow, but not reverse the current decline in nominal ROI and IRR. Moreover, it would make virtually no difference to the projected terminal decline in P&L performance. Even a 15% annual increase in R&D productivity would barely be enough to avoid terminal decline, and the industry’s sales and profits would still fall by almost 50%.

我们能看到的是,从2018年起每年提升研发效率5%、甚至10%可以减缓、但不能扭转目前投资回报率和内部收益率的下降趋势。此外,它对损益表现上的致命衰退几乎毫无影响。即便每年15%的研发效率提升也不足以避免糟糕的衰退,行业的销售和利润仍将下降50%。

In fact, we would need to increase nominal R&D productivity/ROI by at least 20% each year to reverse the projected decline in P&L performance, and even then, the industry’s sales and profits would fall by about one third before they begin to pick up again in 2030. This is because it will take several years for any improvement in R&D productivity to translate into increased sales and profits due to the long investment period. In other words, the next 10 years of P&L performance are already largely determined by the past and current low levels of R&D productivity, and there is now very little we can do about this.

事实上,我们需要提升名义研发效率/投资回报率至少每年20%才能逆转损益表现的下滑,而且即便如此,行业的销售和利润仍然会下滑大约三分之一,在2030年见底后才会重新上升。这是因为,将研发效率的提升转化为销售和利润的增长需要多年的投资期。换句话说,未来10年的损益表现已经由以往和当前低水平的研发效率所决定,我们也做不了什么。

So by when do we need to start making these annual improvements? The charts below show the impact of improving nominal R&D productivity/ROI by 20% per year from 2018, 2020, 2022 or 2024:

那么,我们什么时候需要开始逐年提升呢?下面这些图分别显示了从2018、2020、2022或2024年起,名义研发效率/投资回报率每年提升20%造成的影响:

In short, we need to start improving nominal R&D productivity/ROI by 20% per year right now, from 2018, because the longer we wait the less impact it will have to avoid terminal decline.

简而言之,我们需要从现在、即2018年开始,每年提升20%的名义研发效率/投资回报率,因为等得越久,影响就越小,就更难避免致命的衰退。

A 20% sustained annual increase in R&D productivity is a very high target indeed, which would require increasing the number or average commercial value of new approved drugs by 20% each year, or decreasing the R&D investment required to develop each new drug by 20% per year. So is it achievable? Could any, or even all of Pharma’s strategies for continuous improvement ever make this much impact? Consider that none of Pharma’s past efforts at continuous improvement has made any difference at all to the rapid and steady decline in R&D productivity over the last 60 years. In fact, the impact of Pharma’s past efforts is already included in the current declining baseline, so how reasonable is it to expect that any of Pharma’s current strategies for continuous improvement will increase R&D productivity by an additional 20% each year, on top of what we have been able to achieve in the past?

研发效率每年持续20%的增长确实是个非常高的目标,要求将新批准的药物数量或平均商业价值每年提高20%,或将开发每种新药所需的研发投入每年减少20%。这可以实现吗?是否有一家、或全部的制药企业的持续改进策略可以产生如此大的影响?请考虑到,现在没有哪一家制药企业在持续改进方面的努力对这60年来研发效率的快速稳定的下降趋势产生了多大影响。事实上,制药公司过去努力的影响已经包含在当前下降的基线中,再预期制药公司目前持续改进的各种策略能使研发效率每年再增加20%,这有多大合理性?我们过去为什么没有实现?

I will leave this question open for readers to reflect, meanwhile let us now consider the potential impact of a major breakthrough in R&D productivity.

我将这个问题留给读者反馈,同时让我们再考虑一下研发效率的重大突破造成的潜在影响。

Impact of a major breakthrough in R&D productivity

研发效率的重大突破的影响

Unlike continuous improvement, which requires making incremental annual improvements in R&D productivity over many years, new technologies have the potential to make a significant impact on R&D productivity within a short timeframe, and possibly even within a single year. Now, we have seen many breakthrough technologies in drug discovery over the years, and not one of these has made any difference to the rapid and steady decline in R&D productivity, but still let us consider: What if we could improve R&D productivity now in 2018 by 100%, 200%, 300%, or even 400%? What would be the impact on projected P&L performance?

持续渐进式的提升需要持续多年、年复一年的研发效率提升,与之不同的是重大突破,一些新技术可以在非常短的时间内、很可能仅1年内,就能一次性地大幅提升研发效率。这些年里,我们看到了一些药物发现方面的技术突破,不过没有哪一次突破能对研发效率的快速稳定的下滑产生什么影响,但我们仍然可以设想一下:如果现在,即2018年,我们就可以将研发效率提升100%、200%、300%,甚至400%呢?这会对预测的损益表现产生多大冲击?

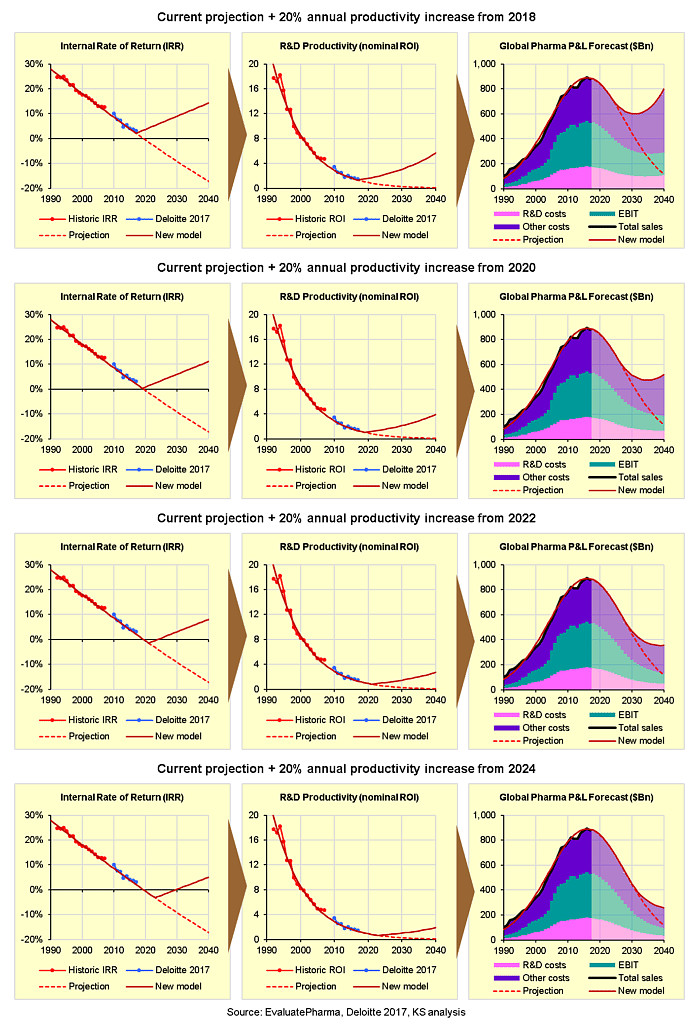

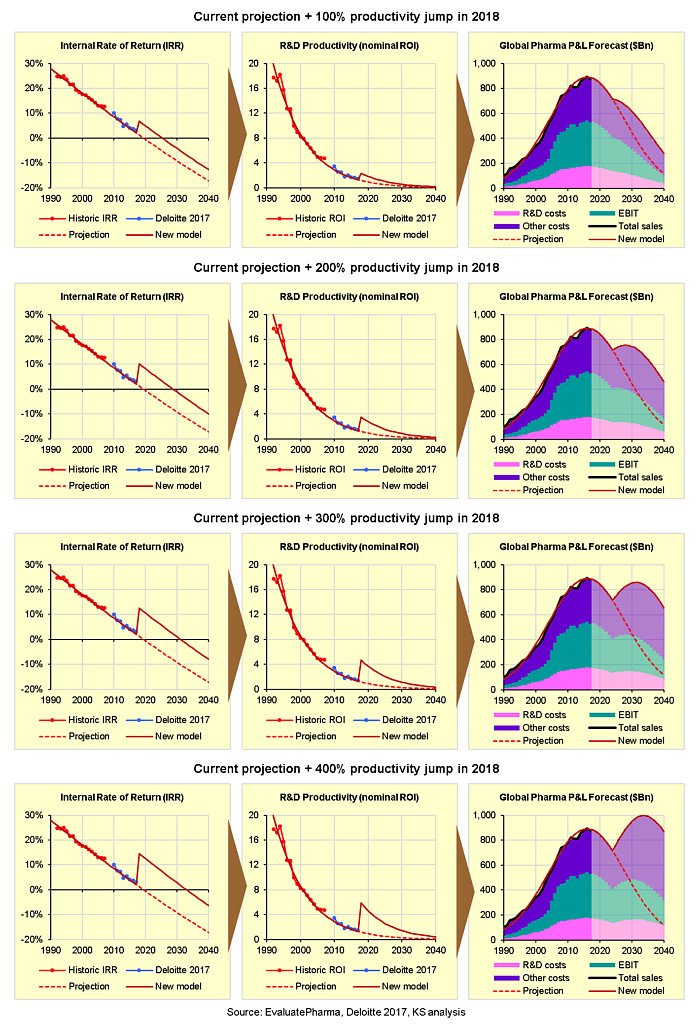

Before we run the calculations, we must consider that a major breakthrough may provide a one-time jump in R&D productivity from the current baseline, but R&D productivity would then continue to decline at the current rate of 10% per year because no improvement is sustainable in the long term due to the Law of Diminishing Returns. On that basis, the impact of increasing nominal R&D productivity/ROI by 100%, 200%, 300% or 400% is shown in the charts below:

在我们计算之前,我们必须考虑到,重大突破可以让研发效率在当前基线上产生一次性的跳增,但研发效率仍然会继续以每年10%的速度下降,因为这种突破不可持续,长期看边际效益递减规律仍会起作用。以这些假设为基础,提升名义研发效率/投资回报率100%、200%、300%或400%的影响如下图所示:

Here we can see that a 100% increase (two-fold improvement) in R&D productivity would delay the tail end of terminal decline by only 5 years, while a 200% increase (three-fold improvement) would delay terminal decline by about 10 years, but would not avoid it, and the industry’s sales and profits would still decline from their peak in the next couple of years. Even a 400% increase (five-fold improvement) in R&D productivity would only delay terminal decline by 20 years, but at least the industry’s sales could reach a new higher peak after a short dip.

我看可以看出,研发效率100%的增长(即2倍于此前)仅仅可以将下滑延缓5年,200%的增长(即3倍于此前)也仅仅可以延缓10年,它们都不能避免下降,而且行业的销售和利润仍将从高峰期开始长年下降。即便研发效率400%的增长(即5倍于此前)也只能延缓下滑20年,不过最起码行业销售可以在回调之后创下新高。

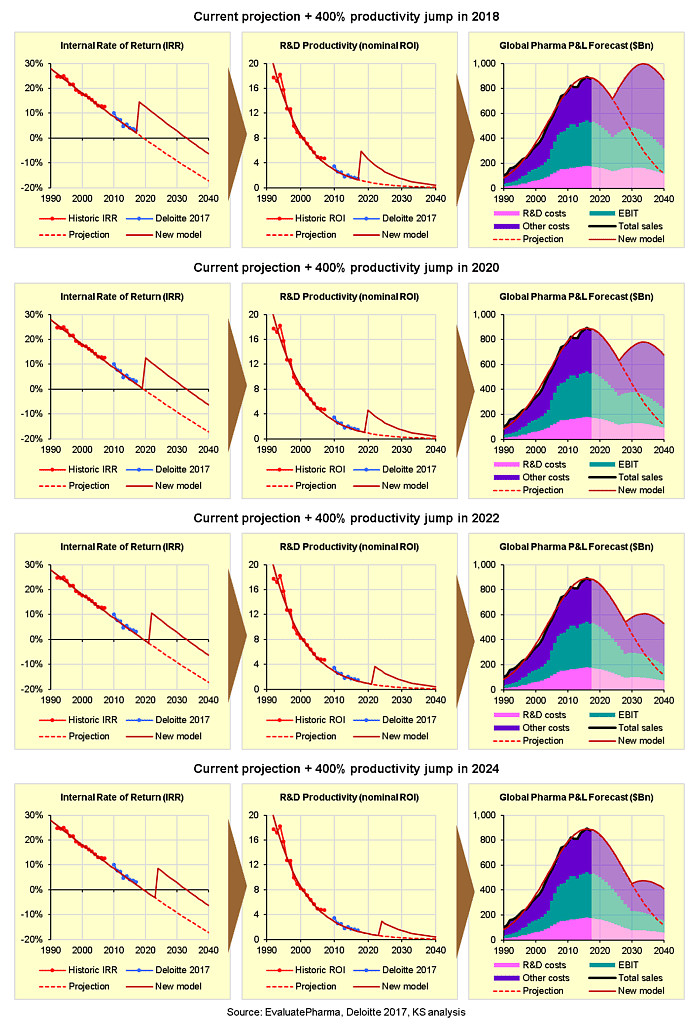

I will discuss below how we might be able to achieve such a breakthrough in R&D productivity, but assuming we could increase R&D productivity by 400%, by when would we need to achieve it? How much time do we have left to develop and implement such a breakthrough?

我将会在后面探讨我们如何做才有望在研发效率上取得突破,但现在假设,如果我们真的能将研发效率提升400%,那么我们什么时候需要它?我们还剩多少时间来研发和实现这样的突破?

The following charts show the expected impact of increasing nominal R&D productivity/ROI by 400% in 2018, 2020, 2022, or in 2024:

下面这些图分别展示了在2018、2020、2022或2024年时,名义研发效率/投资回报率提升400%有望造成的影响:

Here again, the bottom line is that we need a major breakthrough right now, in 2018, because the longer we wait the less impact it will have to save the industry from terminal decline.

这些图又一次显示,底线是,我们必须就在现在,即2018年,创造出一次重大突破,因为等得越久,我们能产生的影响就越小,就更难以将行业从致命衰退中拯救出来。

Now, in order to evaluate how we might achieve this, we need to take another look at the Law of Diminishing Returns to understand exactly what is driving this trend so that we can finally figure out how to address the underlying issue.

现在,为了评估我们如何才能实现重大突破,我们需要再次审视边际效益递减规律,以准确理解什么导致了这个趋势,这样我们才能找到如何解决根本问题的办法。

因雪球长文仅限20000字,下文请见下一贴:网页链接。

原文链接:网页链接

译者:汤诗语 转载请注明

@Stevevai1983 @黑暗时代 @an小安 @只买医药股 @平峰 @xuelangren @梁宏 @不明真相的群众