Virgin America's IPO price could value the company at about 10 times 2015 earnings. This seems more than reasonable. At the close of November 11th, NASDAQ listed a Forward P/E (1y) of 13.39 and 7.74 for Delta Air Lines and American Airlines respectively.

Virgin America would be valued at about $1 billion, or 4.15 times earnings excluding items and adjusted for industry standards. That compares with Southwest, Spirit Airlines Inc. and JetBlue Airways Corp, which are all valued at a ratio of about 5 or higher. Spirit, the most expensive of the three, trades at a multiple of 5.71.

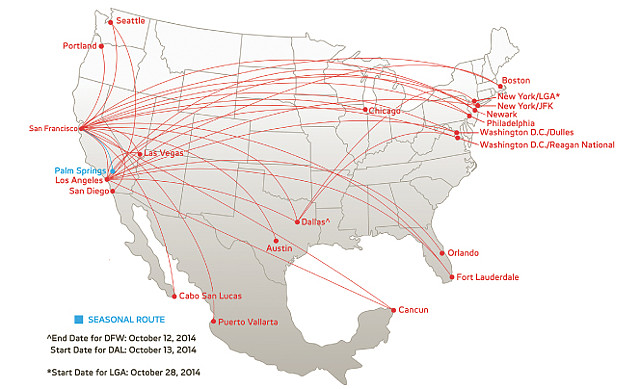

公司航线

公司过去9个月是盈利的,这个很难得,最近油价下降,对航空公司是利好,Delta已是一年来的高点,公司跟delta在很多国际航线有合作关系,既是竞争对手又是合作伙伴,公司收入从2009年$547MM增长到2013年的$1.4B, 13年和14年收入增长放缓。最大的顾虑是公司目前有$803MM贷款,公司总资产也不过$876MM,加上其他负债,股东权益是负$334MM,加上融资$330MM,公司股东权益刚刚为正,考虑到公司已经开始盈利,资产负债率会慢慢降下来。

公司8亿多美元的贷款主要是跟两个大股东之间的贷款,公司在2013年的时候重组了贷款。贷款重组后具体如下(摘自S-1):

A summary of the key terms of the recapitalization agreements is as follows:

a) The Company’s stockholders exchanged $556.0 million of related-party debt which previously had contractual interest rates of 15%-20% per year for $369.1 million of related-party debt at a lower interest rate of 5% per year (5% Notes) and for warrants to purchase 21.2 million shares of Class C common stock at an exercise price of $18.87 per share.

b) The principal and accrued interest of approximately $131.5 million of related-party subordinated notes (the Subordinated Notes), along with the associated warrants, were exchanged for warrants to purchase 1.0 million shares of Class C common stock at an exercise price of $0.08 per share;

c) The Company issued $75.0 million aggregate principal amount of new debt pursuant to the Fifth Note Purchase Agreement (the “FNPA II”), which debt had a stated paid-in-kind annual interest rate of 17%, and also issued warrants to purchase 1.0 million shares of Class C common stock at an exercise price of $18.87 per share.

公司估值合理,油价低是利好,客户体验非常不错,飞机也都很新,经常会有特价票,做完他们飞机的朋友都会推荐。开盘24元以下肯定入,超过26看看上升趋势怎么样,个人建议仅供参考。

$Virgin America(VA)$ $一嗨租车(EHIC)$ $Wayfair(W)$ $Cyber-Ark Software(CYBR)$