1847 Goedeker: An Under The Radar Potential Multibagger

Summary

Goedeker (GOED) is bringing to market privately held Appliances Connection Group.The combination of Goedeker with ACG will generate the biggest pure online appliances and furniture retailer in America.The business is high growth, profitable, and selling at a fraction of e-commerce comparables. Current market cap is below the price paid for ACG.91 million warrants at $2.25 represent the biggest obstacle in the near-term for price appreciation.

I was attracted into 1847 Goedeker Inc. (NYSE:GOED) by the crazy action in the stock price on Thursday May 27th. That day the stock opened up almost 300%, on no news, got halted several times to finish the day up 50%. After market close, the company announced a massive capital increase of almost 7 times its market cap and cratered 70% after hours. It went from 14.4 to 1.80 in just a few hours! I don't recall seeing anything like this before, a record even in the crypto world.

It called my attention that a 30 MM micro-cap company can raise such an amount of capital and it was determined to do it at a 70% discount to its closing price, severely diluting its small shareholder base, of which over 60% were insiders. The company announced the issuance of 91 MM new shares at $2.25, plus 91 MM 5-year warrants with exercise price $2.25 that can be exercised at any time. A deluge of new securities for a small company with only 6.1 MM shares outstanding. I decided to investigate further and to my surprise I believe I have found a very compelling investment opportunity completely under the radar.

The Players:

1847 Goedeker Inc. (GOED) operates an e-commerce platform for appliances and furniture in the United States. The company also provides appliance installation services and old appliance removal services. 1847 Goedeker Inc. was founded in 1951 and is based in Ballwin, Missouri. It was acquired in 2019 by an investor group led by current CEO Douglas Moore, who was previously CEO of Med-Air Homecare, and current CFO Robert Barry. They took the company public in June 2020 and have grown the business considerably since. Still, the company lacks the volume to make its operations profitable and that is the reason for the capital raise, as they are buying the top dog in the online appliance and furniture business and that is privately held Appliances Connection.

Headquartered in Brooklyn, New York and founded in 1998, Appliances Connection is one of the leading retailers of household appliances with a 200,000 square foot warehouse in Hamilton, New Jersey and a 23,000 square foot showroom in Brooklyn, New York. In addition to selling appliances, it also sells furniture, fitness equipment, plumbing fixtures, televisions, outdoor appliances, and patio furniture, as well as commercial appliances for builder and business clients. It also provides appliance installation services and old appliance removal services. Appliances Connection serves retail customers, builders, architects, interior designers, restaurants, schools and other large corporations. It ships to 48 states in the Continental United States and offers nearly 300,000 products.

Why I think this is a very compelling investment idea:

I went through the over 300 pages of their preliminary prospectus from May 24th. and I came to the conclusion that the business proposition is very appealing for new investors buying after the recent price debacle. 1847 Goedeker, as a standalone company is not really an interesting story, it is growing fast but it is starting from a low base but yet revenues and margins are not enough to make the operations profitable. Appliances Connection, on the other hand, has even more growth, higher volumes and higher margins than GOED and the business is highly profitable.

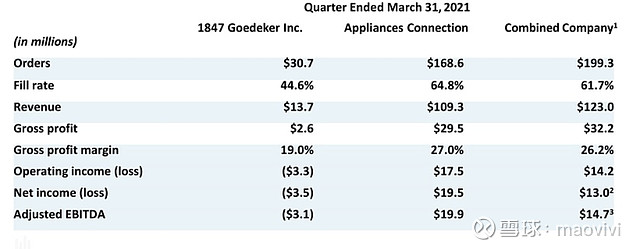

1) Revenue growth is impressive and this even taking into consideration that due to COVID related and shipping problems from manufacturers the fill rate is quite low. For instance in 1Q 2021 Goedeker was able to only ship 44% of the over $30 MM in orders it had and Appliances Connections had orders for $168 MM and only shipped $109 MM. I believe at the current rate the combined company will have over $500 MM in revenues in 2021.

2) The combined company is profitable. Appliances Connections Group (ACG) has a real business while Goedeker struggles to become profitable. I believe there are lots of synergies to be made from combining both operations, especially if they look into integrating Goedeker into ACG and not the other way around. Savings can be made in advertising, SG&A and credit card fees, which I find outrageous. As can be seen from the combined statement of operations from year 2020, ACG has 6x times the revenues and 9x the gross profit of GOED and only 2x operating expenses.

First quarter financials 2021 are even better, with ACG net income at $19 MM and Goedeker losing $ 3.5 MM, with improvements in all metrics.

3) Service Level is best in class, this is very important as this industry is highly specialized, in particular delivery of large appliances like washing machines, refrigerator, kitchens, etc. Customers need to arrange delivery, installation and removal of the old machines. This is not a business where a company like Amazon (AMZN) will bother to get into and the combination of Goedeker with ACG will generate the biggest pure online appliances and furniture retailer. Their real competitors are big box retailers like Best Buy (BBY), Lowe´s (LOW) and The Home Depot (HD), but they carry a more limited product assortment and they have huge cost overhead that these online players don't have and they can pass these saving to their clients.

Customer reviews are impressive as well considering that this is a service where so many things could go wrong.

Valuation:

1847 Goedeker is paying $222 MM in total consideration for ACG, of this $180 MM is payable in cash and the rest in stock. They will pay 2.3 MM shares at a price of $9, which was the price in October of last year when the deal was announced and an additional 3.2 MM shares at a price of $6.46, which is the average price of the previous 20 days before closing. So in total after the 91 MM shares being offered at the market at $2.25 and the 6.1 MM shares currently outstanding, there will be a total of 102.6 MM shares outstanding after the deal closes. To this, we have to add an additional 91 MM shares that could be issued if the warrants are exercised. There could be an additional 2 MM shares if the underwriter subscribe the overallotment.

As I write this article, the pre-market price of GOED is $2, which gives the combined company a market cap of $204 MM, less than what GOED is paying for ACG. Given the revenue growth, margins and profitability of ACG, I think anybody will have a hard time finding a more compelling value in today stock market. If the 1Q 2021 earnings from ACG is something that can be annualized, we are talking at a P/E of just over 2.5!!! The balance sheet will be in good condition as well, as they are taking a $60 MM Term Loan, but will have $40 MM cash, so net debt is $20 MM.

Unfortunately, Goedeker for now subtracts, but over time it will add as synergies get materialized. Worst case, they could close Goedeker and just keep ACG.

This is a comparison the company prepared in the Investor Presentation of May 2021.The market cap was calculated with the stock price on May 21st, which was $5.71, now the price is $2. At the current market cap of $204 MM the combined company trades at just 40% of MY estimated 2021 revenues of $500 MM, comparable companies trade at 8 to 10x those multiples. The comparables in this study are Wayfair (W), Overstock (OSTK), Purple Innovation (PRPL) and The Lovesac Company (LOVE).

The problem are the 91 MM warrants, which could be exercised at any time and will be a big overhang in the near term until the market works it out. When those warrants get exercised the company will receive $205 MM in cash which will surely be spent in new warehouses and acquisitions to fuel their growth going forward.

Another piece of good news is that the principals from Appliances Connection, Albert, and Elie Fouerti, will continue in their current leadership roles and Albert Fouerti will join the board of directors of 1847 Goedeker. They founded ACG 20 years ago and they bring a lot of experience to the new company.

In conclusion, I believe the management and insiders of Goedeker took the right decision to pull forward with this transaction even it meant pulverizing their stock ownership in GOED. As a standalone, GOED stood little chance of success without ever more capital injections, so by merging with ACG they solved all their financial problems and allows them to really move forward and grow the business. I believe that the current volatility in the stock price will end this week as the market digests the transaction, investors seem to have dumped their newly minted stock on last Friday session as 96 MM shares exchanged hands but kept the warrants as only 3 MM warrants were traded.

I am always on the search for stocks that offer a reasonable possibility of offering a 100% return within 2/3 years, that increased potential profitability obviously comes at a higher risk, but a diversified portfolio with several of these stocks has worked very well for me. I recently wrote a Seeking Alpha article on a small company called Senseonics (SENS), I believe this investment possibility would be appealing to the same type of investor.

I will be buying shares of GOED this morning Monday June 1st.