Executive Summary

Company Overview

McKesson Corporation is a pharmaceutical wholesaler and distributor headquartered in the United States. Its main operations include sourcing and distributing branded, generic, and specialty pharmaceutical products to pharmacies, hospitals networks, and healthcare providers. Additionally, the company supplies medical-surgical products and equipment to healthcare facilities and provides a variety of technology solutions for pharmacies.

“Advancing Health outcomes for All” is a commitment McKesson has made through its research and development, products and services along with its social initiatives.

Business Segments

The company operates its business in four reportable segments: U.S. Pharmaceutical, Prescription Technology Solutions (“RxTS), Medical-Surgical Solutions, and International.

First, McKesson’s U.S. Pharmaceutical segment provides distribution and logistics services for branded, generic, specialty, biosimilar, and OTC pharmaceutical drugs along with other healthcare-related products to customers. This business segment provides solutions and services to pharmacies, hospitals, oncology, and other specialty practices.

Second, the Prescription Technology Solutions (RxTS) segment works across healthcare to connect patients, pharmacies providers, and biopharma companies to deliver medication access and adherence solutions that support patients from first prescription fill to ongoing therapy.

Third, the Medical-Surgical Solutions segment delivers medical-supply distribution, logistics, biomedical maintenance, and other services to healthcare providers across the alternate-site spectrum.

Last, the International segment provides distribution and services to wholesale, institutional, and retail customers in Europe and Canada where McKesson owns, partners, or franchises with retail pharmacies.

Investment Thesis

Thesis #1: Growth in Healthcare Industry presents Opportunities

The global Healthcare market was valued at US$166B in 2022 and will grow at a CAGR of 10.77% to reach a value of US$277B by 2027. Current trends and development point to an aging population phenomenon happening worldwide. According to Forbes, the number of people aged 60 and older is expected to grow from 1 billion in 2020 to 1.4 billion in 2030, where 1 in 6 people worldwide will be considered an elderly. This would mean greater demand for healthcare services and medications, driving the sector’s demand.

Being a key player in the industry, McKesson has the resources and expertise to tap on the growth through its continuous expansion into its four different business segments.

Thesis #2: Expansion in Oncology and Biopharma platforms

McKesson formed a new Oncology Research Business with HCA Healthcare, with the aim of expanding clinical research, accelerating drug development, and increasing availability and access to clinical trials for community oncology providers and patients. Building on the strength of its core businesses, McKesson continues its advancement in the areas of oncology and biopharma services through acquisitions and partnerships.

This would afford McKesson a competitive advantage, particularly as the Oncology Market is projected to witness substantial growth from 2023 to 2031. The market, valued at $140 billion in 2021, is expected to experience a CAGR of 7.82%.

Thesis #3: Sustainable Growth in the Long Term

In the aftermath of the pandemic, McKesson acknowledges the significance of a resilient supply chain. During the fiscal year 2023, McKesson utilized its supply chain proficiency to successfully implement numerous substantial customer agreements and renewals. Notably, this involved the extension of their pharmaceutical agreement with CVS Health, a partnership spanning over two decades.

In addition, McKesson continues to invest in its distribution centers and network to meet the growing demand of their customers for their specific needs. For example, McKesson opened a new state-of-the-art USP distribution center in Jefferson, Ohio, to enhance control of their distribution capabilities.

Risks

Risk #1: Litigation and Regulatory Risks

As a pharmaceutical company, McKesson is routinely named as a defendant in litigation or regulatory proceedings. These proceedings include allegations such as false claims, healthcare fraud and abuse, and antitrust violations.

While McKesson maintains a legitimate defense, engaging in legal disputes are often costly, time-consuming, divert management attention, and are disruptive to normal business operations. The uncertainty and financial burden associated with these legal disputes have the potential to adversely affect McKesson’s business even after the resolution of legal cases.

Risk #2: Failure in completion or integration of acquisitions

McKesson’s growth strategy includes consummating acquisitions or other business combinations that either expand or complement their business. To finance such acquisitions, McKesson may need funding that might not be accessible on favorable terms, and obtaining necessary regulatory approvals for proposed transactions is not guaranteed.

Risks associated with achieving desired outcomes include challenges in integrating operations and systems, as well as the potential difficulty in retaining key personnel from the acquired companies. Risks involved in achieving desired outcomes would include integration of operations and systems, and the difficulty in retaining key acquired company personnel. Risks related to acquisitions may have materially adverse impact on its business operations and financial position or results of operations

Risk #3: Adversely impacted by competition and industry consolidation

McKesson’s businesses face a highly competitive global environment with strong competition from various competitors, including specialty distributors, service merchandisers, all at an international, national, regional, and local level.

In addition, due to consolidation, a few large suppliers control a significant share of the pharmaceuticals market. This concentration would thereby reduce McKesson’s ability to negotiate favorable terms with suppliers and cause the company to depend on smaller number of suppliers

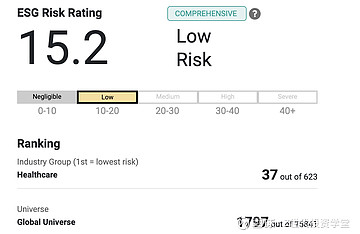

ESG Considerations

As per Sustainalytics, McKesson Corporation holds an ESG risk rating of 15.2, placing it in the "Low" risk category. Among the companies in the healthcare industry, it is ranked 36 out of 623. Sustainalytics' ESG risk ratings gauge a company's vulnerability to industry-specific material ESG risks and its effectiveness in managing them. Consequently, this indicates that McKesson Corporation has a low exposure to such risks.

Environment

Greenhouse Gas Emissions

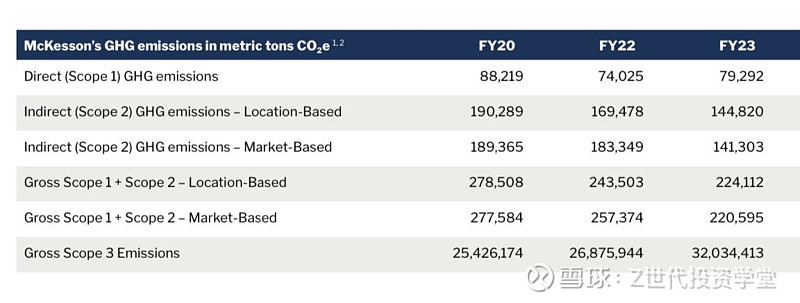

McKesson recognizes the role it plays towards reducing emissions across its value chain and has since made a commitment towards working with its suppliers in connection with their SBTi targets.

Their targets include:

Reduce Scope 1 and 2 GHG emissions by 50.4% by FY32 from a FY20 base year

Ensure 70% of McKesson suppliers, by sending covering purchased goods and services, have their own SBTi-approved GHG emissions reduction target by FY27.

Below shows McKesson’s good progress towards reaching its GHG emissions targets in absolute terms.

Social

Social Contribution

The McKesson Foundation was founded in 1943 dedicated to advancing health outcomes for all. The Foundation’s mission is to remove barriers to quality healthcare across North America, with a strong focus on the vulnerable and underserved communities.

In 2023, the Foundation renewed its 80-year-long-commitment to championing health equity by expanding its portfolio of non-profit partners. It has also been increasing its financial contributions to organizations with a focus on cancer prevention, screening and treatment.

Governance

Employee Well-Being

McKesson emphasizes the importance of the welfare of its employees. Their approach to supporting employee satisfaction and purpose is integrated in their ILEAD principles, which guide McKesson in their commitment towards driving better health outcomes. In addition, McKesson seeks employees’ feedback through annual and mid-year employee opinion surveys, thereby assessing their levels of engagement, commitment, and overall satisfaction using industry benchmarks.

Furthermore, in 2023, McKesson received two awards and recognitions exemplifying its commitment to diversity and inclusion - namely the “Best Place to Work for Disability Inclusion” and are recognized by Forbes as one of “America’s Best Employers for Women”

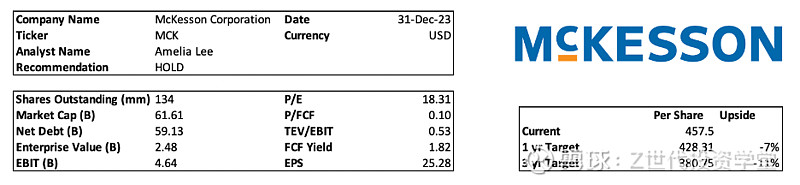

Valuation

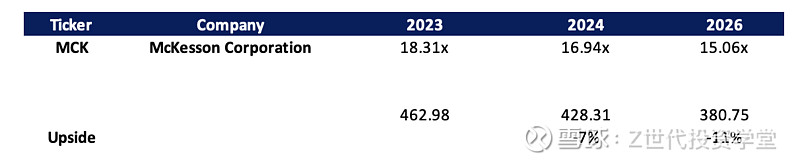

Using company multiples to value McKesson Corporation, I arrived at a 1-year target price of $428 and a 3-year target price of $380, with an upside of -7% and -11% respectively.

Trading comps of McKesson Corporation

McKesson 1-Year and 3-Year Target Price

While taking into consideration the growth of the Healthcare industry with the potential of McKesson Corporation’s ability to capture part of it and its progress and advancement in Oncology, which is expected to grow in the medium term, McKesson’s share price seems to be modestly overvalued.

Conclusion

McKesson Corporation established itself as a market leader among its competitors through its strength in its distribution expertise, advanced technology differentiation and superior specialty assets particularly in the Oncology field. The company is also a leading distributor in community oncology and specialty therapies, a field that is expected to grow in the coming months. Its extensive network of providers and pharmacies also place McKesson in a favorable position.

Despite the positive outlook of the company and strong financial performance, its current share price is trading at a multiple higher than its industry peers, and is therefore modestly overvalued. I would recommend a HOLD on McKesson Corporation for the next twelve months.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。网页链接