Industry Overview

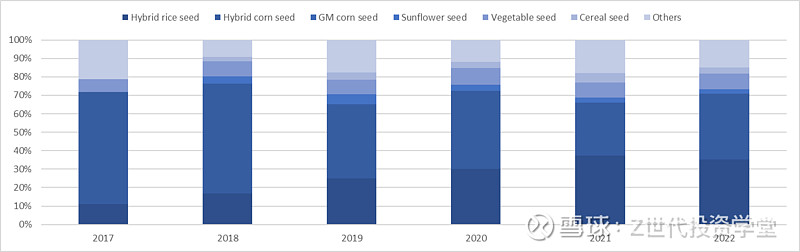

Various types of seeds available in the market

Conventional seeds

Heirloom seeds. Seeds’ characteristics are passed down from generation to generation (of plants that is) and many can be traced back 100, 200 or even 300 years. The big benefit of using heirloom seeds is that you can collect seeds from your plant at the end of the season and when you plant them.

Hybrid seeds. Hybrid seeds are obtained from cross-pollination of two or more different plant varieties. These are first-generation offshoots of different parent lines and involve crossing a male and female parent. The respective parent lines are chosen, keeping in mind the specific desired traits. Given that hybrid seeds are designed to contain the best characteristics of carefully chosen parents, these are relatively high performance seeds versus naturally pollinated ones

Genetically modified seeds. Genetic modification involves transferring a gene from one kind of organism to another. GMO seed varieties will retain their original characteristics if saved and replanted, but because GMO seeds are patented by the companies producing them, intellectual property rights restrict using saved seed the next season

Genetically edited seeds. Gene-editing is a novel breeding technology that is used to develop new and improved seed varieties (crop yield increases, nutritional enhancements etc.). GE crops are produced by cutting out and/or modifying an existing part of a plant's DNA.

Industry market size

Seed market size is a function of demand of seeds * price of seeds. Demand of seeds = Plantation acre * unit utilisation rate * commercialisation rate. Price of seeds = economic benefit brought by seeds.

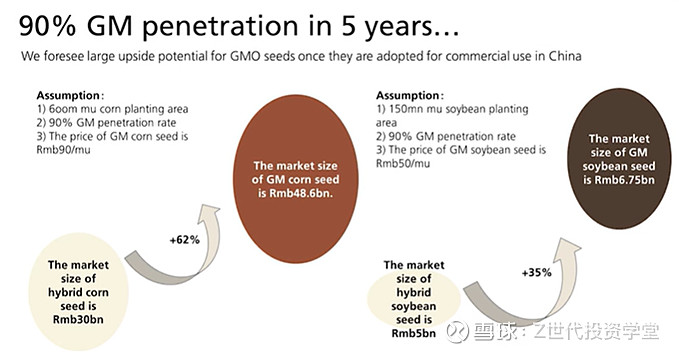

Globally, seeds industry is a mature $42bn market growing at a 3.3% CAGR through 2021-26. In China, seeds industry has been stable in the past few years. However, market is expecting double digit growth for seeds industry in China from 2023 onwards, driven by increased penetration of GM seeds post liberalisation of GM planting rules.

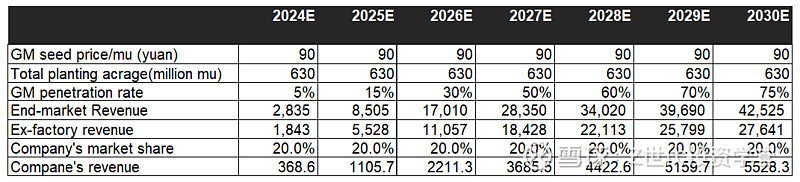

UBS is rather bullish towards the growth of GM seeds in China, with assumption of 90% GM penetration within 5 years once the GM seeds are adopted for commercial use in China.

Industry driver

Food security has become a major policy focus for Chinese governments over the last few decades.

China has limited access to fertile land. Despite being one of the most populated countries in the world with ~20% of global population, China only has ~7% (~175mn ha) of global arable land.

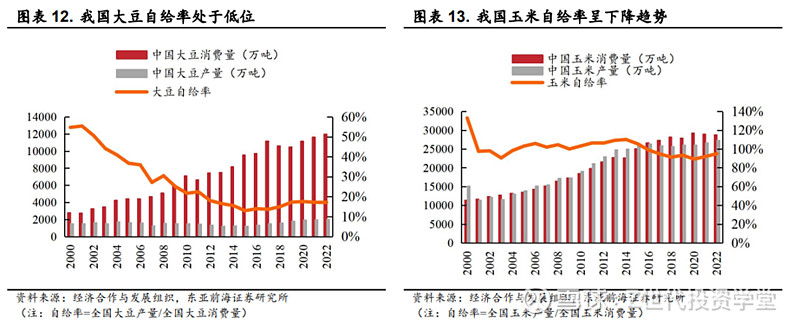

The country has struggled to secure its own production chains over the years and imported more than 100mn tons of soybeans in 2020, accounting for ~85% of domestic consumption that year.

Climate change is not helping at all. In the past few years, China has experience its worst drought (2020) and record-breaking rains, damaging nearly 15mn ha of crops, delaying planting on more than 9mn ha of land (2021).

As a response, China aims to build a "national food security industry belt” and become a self-sufficient grain producer. Under the new plan, Beijing officials aim for 700mn tons of grain output by 2025. China strives for complete self-sufficiency in production of two main crops, namely wheat and rice. For soybeans, rapeseed, and maize, the nation aims to rise production by 40%, 30%, and 2% by 2025, respectively (compared to 2021).

Why is seed industry key to achieve food security? And why do we think seed industry in particular will grow?

Yield improvement

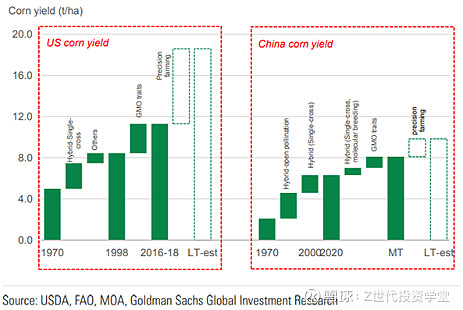

Crop yield growth can be achieved in two ways: to grow more and bigger plants on the existing area or to make sure current crops in the ground achieve full potential. To grow and bigger plants on an existing area (allow for higher planting density), we need high quality seeds.

What do we mean by high quality seeds? High quality seeds are seeds with optimized germplasm and traits which can deliver higher intrinsic yield and cost savings, and adapt to consumer food tastes and nutrition requirements.

In this context, China is on its pathway switching from conventional and hybrid seeds to GM seeds or even GE seeds. We anticipate that GM products will be widely promoted across China due to several factors: (1) Positive government attitude: The Chinese government has shown a favorable stance towards GM products, indicating its support for their adoption and use in agricultural practices. (2) Growing pipeline of GM technology/products: There is an increasing number of GM technology and products in the development pipeline, suggesting a strong interest and investment in advancing genetically modified crops and seeds. (3) Tight corn supply and pest challenges: China's corn supply is under pressure due to increasing demand and challenges posed by pests. GM products offer a potential solution to address these issues and enhance crop yields and resistance.

Goldman Sachs expects the first generation of GM seeds in China (most insect resistant and herbicide tolerant) to potentially bring an average improvement of 10% in yield for corn and 5% for soybean, significant reduction in both herbicide and pesticide costs including weed management, as well as lower mycotoxin in the grain produced.

Encouraging policies and regulations by Chinese government

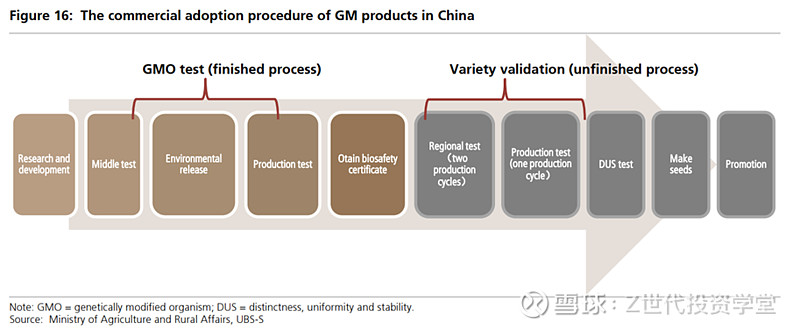

China has introduced several policies pertinent to GM since 2020, ranging from the issuance of GM biosafety certificates, encouraging the commercialisation of biological breeding, and stepping up efforts to crack down on illegal GM. These policies should create a favourable legal environment for the potential commercialisation of GM products. For example, the new Seed Law and the special crackdown on intellectual property theft in the seed industry will strengthen the protection and utilization of germplasm resources, and crack down on illegal seed practices.

Market structure

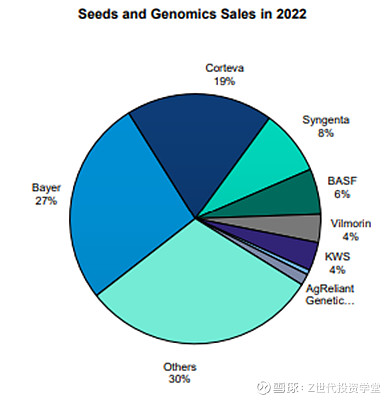

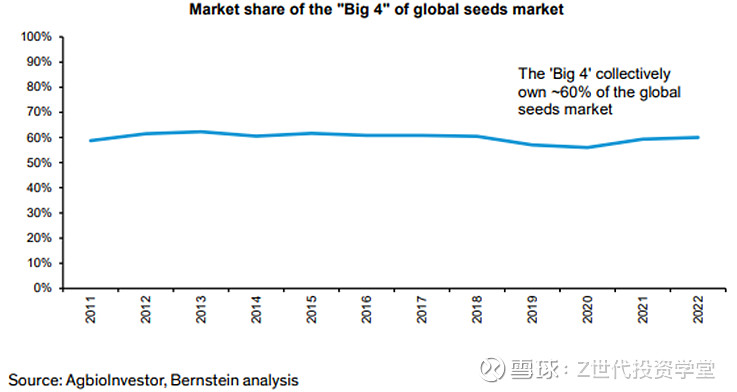

The global seeds industry is characterized by an oligopolistic structure, where a few major players dominate the market. The top integrated companies consistently hold approximately 45% of the total market share, with the next two leading companies accounting for another ~15% of the market share. This distribution of market share has remained relatively consistent over time, indicating the presence of a science-led moat, which provides these companies with a competitive advantage.

Despite facing the ongoing challenge of generic competition from other players, the four leading companies, often referred to as the "Big 4," have managed to maintain their market share at around ~60% over the past decade. This stability in market share demonstrates the strong position and resilience of these major players in the face of competition.

The seed industry in China started relatively late, and its early stages witnessed low entry barriers, leading to the proliferation of numerous seed companies. The resulting low industry concentration caused disorderly competition, giving rise to counterfeit and inferior seeds, which hindered farmers' access to improved varieties and hampered agricultural production efficiency.

However, we believe that industry consolidation is an inevitable trend. Since the implementation and reform of the Seed Law of the People’s Republic of China in 2000, tens of thousands of seed companies have been strategically integrated into several thousand companies. The rectification measures have eliminated small companies relying on imitation and infringement, while larger companies, including key players and the top 50 companies in China’s seed industry, now hold dominant seed varieties.

With improving grain fundamentals and the promotion of new GM (Genetically Modified) products, which have significant GMO R&D entry barriers, we anticipate that the concentration and profitability of the seed sector could improve. The commercialization and widespread adoption of GM products could potentially double the revenue of that particular seed segment for certain companies and elevate the sector's concentration ratio. Consequently, we favor market leaders with strong GM R&D capabilities.

Drawing upon overseas markets as a reference, we observe that the commercialization of GM products significantly raised the seed sector's entry barriers globally, with four clear market leaders dominating the current global market in 2018, accounting for 63% market share. In contrast, China's seed sector had a CR10 (Concentration Ratio) of only 18% in 2020.

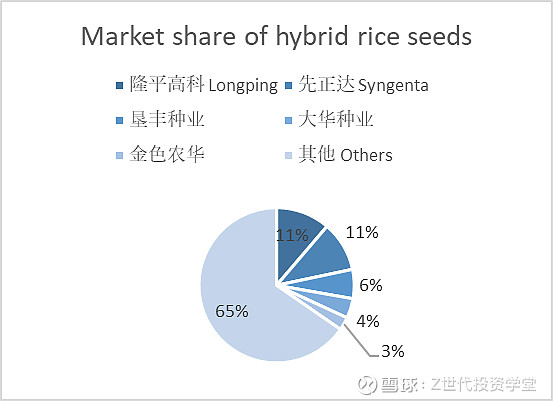

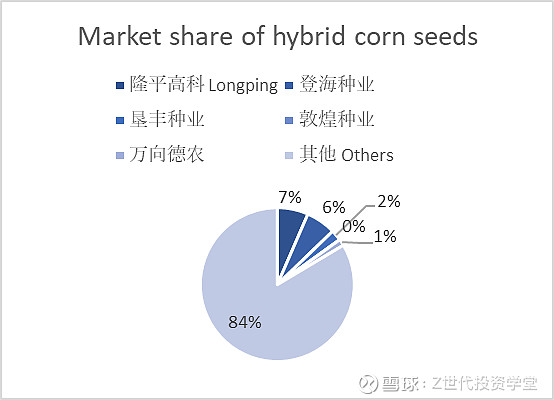

Market landscape of hybrid rice and corn seeds in 2021 (Source: CICC)

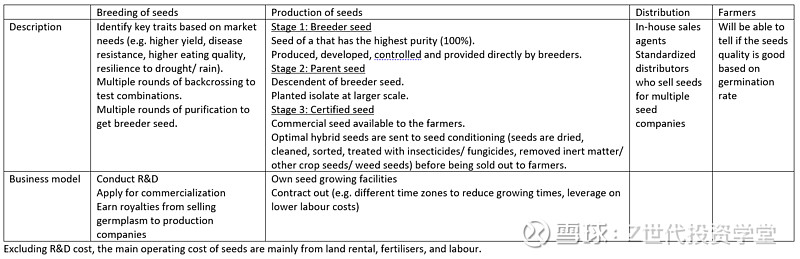

Seed value chain (hybrid seed) – Longping is an integrated seed company which does R&D (breeding) and production of seeds

Company Overview

Longping High-Tech is a hybrid rice seed and corn seed leader in China. The company mainly engaged in the R&D, production and sale of crop seeds. The company's main seed production business is positioned at "3+X", with rice, corn, and vegetables as the three core categories, with wheat, potato, cotton, rapeseed, peanuts, and soybeans as auxiliary businesses.

Business segments and its revenue drivers

Hybrid rice seeds (35% of sales revenue)

The reserve purchase price for rice has been raised under the food security policy. The rise in rice price bodes well for improvement in the rice seed sales environment. The firm’s core rice business is highly competitive, and its commercial rice breeding system covers domestic and overseas markets. Longping has had the largest market share in rice seeds in recent years. In 2021, the firm received approval for 88 new rice products, laying a solid foundation for its future growth. In addition, the firm has been reforming its rice business by optimizing inventory and marketing systems, etc. Overall, we believe the firm’s provision for impairment of rice inventory could gradually decrease quarter by quarter, and the inventory-to-sales-ratio could improve. It is estimated that rice seeds segment will grow at high single digit numbers (8-10%) by the next five years.

Hybrid corn seeds (36% of sales revenue)

The company's corn reserve varieties include Longping 208, Longping 211, Longping 702, etc. Longping has also strategically cut into the corn seed market in Northeast China, and Longping 702 has been successfully popularized in Northeast China. The company's corn seed marketing is very thorough and meticulous, and has established a good marketing relationship with local distributors. Given the introduction of GM corn seeds, we foresee cannibalisation from this segment, hence forecasted high single digit growth (with decreasing trend) for this segment.

GM seeds (mainly corn seeds)

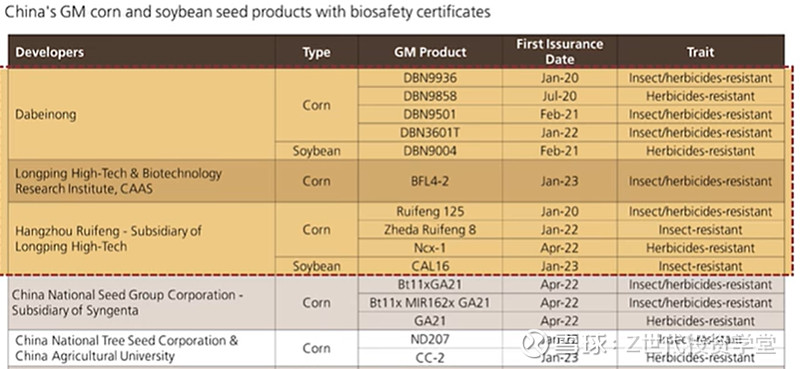

Genetically Modified Organism (GMO) research and development is a costly process, leading to relatively higher GMO seed prices compared to foreign counterparts, resulting in higher Gross Profit Margins (GPMs) for international GMO businesses. These foreign GMO companies generate profits through two main channels: 1) charging GMO patent-licensing fees on a per-acre basis, and 2) direct sales of GMO seeds. In China, only a limited number of companies possess the necessary product and technical expertise, with just two having obtained the biosafety certificate from China's Ministry of Agriculture – namely, Longping and Dabeinong.

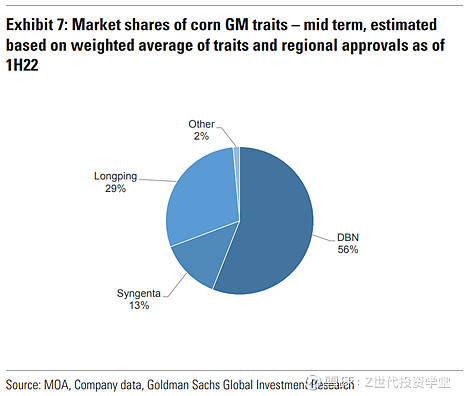

Among them, Longping, via Hangzhou RFGene, has secured three safety certificates for GM corn products, potentially granting them a significant first-mover advantage. In 2022, the total GMO seed production area in China reached 66,000 mu, with Longping accounting for 21,000 mu. The expected timeline for GMO seed adoption in China is estimated to commence from 2024.

Core competitive advantage

High R&D investment. The core for seed companies to expand their market share depends on the competitiveness of high-quality seed products. At present, there are many main players in the seed industry in China, but most of the companies have weak R&D capabilities for new varieties. Longping’s R&D to sales ratio has been consistently more than 5%, which is significantly higher than its peers. Up to now, it has established several R&D platforms with regard to GMO corns, including Hangzhou Ruifeng, Longping Biotech, Green Valley Biotech and Guofeng Biotech, and four corn traits belonging to Longping and its subsidiaries have been granted GMO safety certificate (13 corn traits in total have been granted the certificate in China), showing LP's significant early-mover advantage. Biosafety certificates issued by China's Ministry of Agriculture and Rural Affairs are required before GM products can be commercialised. After this, developers need to apply to the Seed Management Department under China's Ministry of Agriculture and Rural Affairs for the validation of the new plant variety. After the variety validation is completed, the product can be commercially cultivated in the ecological area designated by the variety validation certificate. It is estimated that having a headstart will give Longping 2-3 years leeway as compared to peers who have just started.

Management and efficiency improvement. The inventory-to-sales volume ratio and R&D capitalization ratio continued to improve, and the disposal of inefficient assets in non-main businesses accelerates. The firm’s inventory-to-sales volume ratio and R&D capitalization ratio have fallen from 156% and 70% in 2019 to 77% and 16% in 2022, already at the normal level. In addition, the firm has accelerated the disposal of inefficient assets in non-main businesses to improve asset quality.

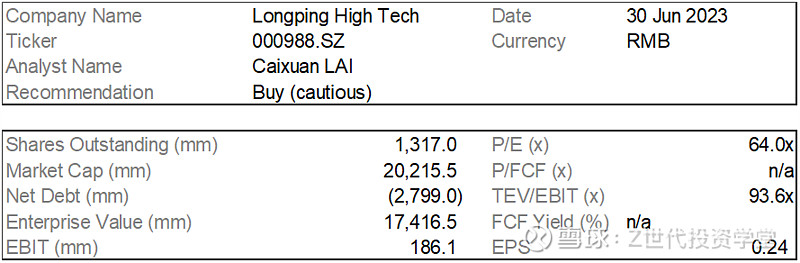

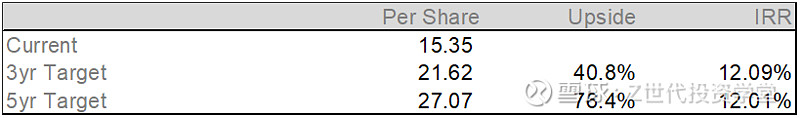

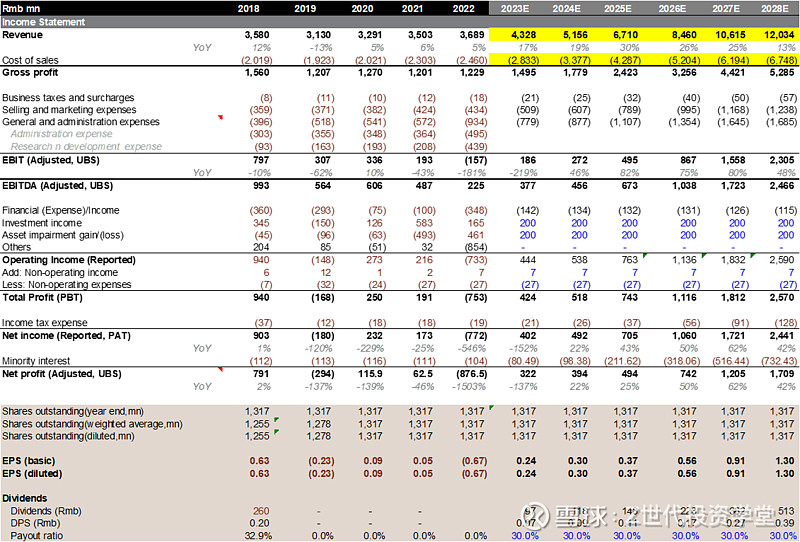

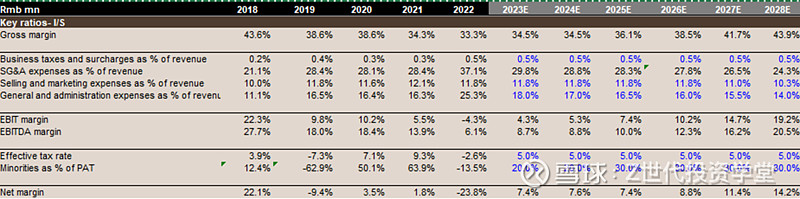

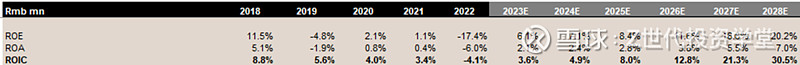

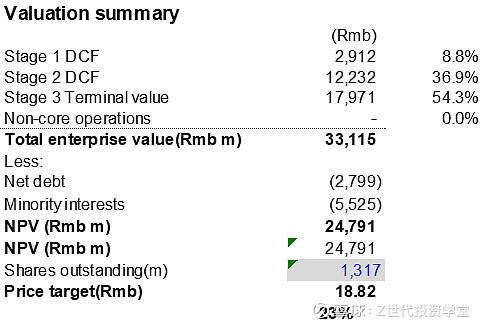

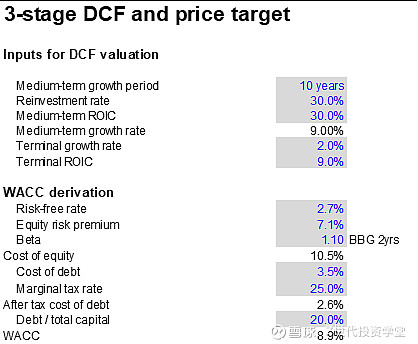

Model and Valuation

Target price as of end of 2024: RMB18.82

+23% from current RMB15.35 price. Cautious BUY.

2024PE of ~60x seemed to a bit too high if compared to global peers.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。网页链接